In a world increasingly dominated by discussions surrounding renewable energy and electric vehicles, it’s easy to overlook the underlying currents driving the traditional oil and gas sectors. I recently found myself reflecting on the limits of technological advances and the indisputable need for tangible resources. It was during this moment of contemplation that the necessity of capital expenditure (CapEx) in the energy sector crystallized for me, framing it as the backbone for achieving stable returns and sustainable growth in turbulent times.

The Decade of Shortages: A Wake-Up Call for Investors

It’s hard to ignore the growing whispers about shortages in various industries. Have you noticed how capital expenditure (CapEx) cuts over the last decade have dramatically impacted key sectors? This situation is a wake-up call for investors. The energy sector, in particular, has been undercapitalized, leading to significant supply constraints.

Understanding the Impacts of Prior CapEx Cuts

Let’s break it down. Over the past ten years, many companies have slashed their capital spending. Why? To cut costs and improve short-term profitability. But this has had serious long-term consequences. The energy market is facing critical depletion issues. Finding new oil reservoirs? It’s becoming increasingly difficult.

According to Adam Rozencwaijg, managing partner at Goering and Rozencwaijg, the cyclical nature of the oil business is heavily influenced by capital flow. With a consistent lack of reinvestment, we’re left with a tight market. It's not just about geopolitical tensions; the real issue lies in the CapEx cuts.

The Expected Return for Investors in Undercapitalized Markets

Now, let’s talk about returns. There’s a silver lining here for savvy investors. Adam believes that targeting undercapitalized markets, particularly in the energy sector, could yield extraordinary returns. He states,

“We expect an unbelievable return for investors looking at this space.”

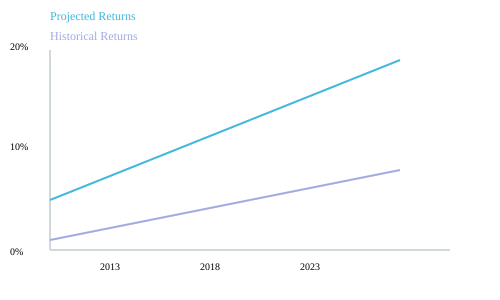

Imagine projecting a 20% return for those willing to invest in revitalizing these industries. It’s not just a dream; it’s a real possibility. The current landscape suggests that uninvested or undervalued assets could be key opportunities. Investors who can identify these assets may find themselves in a lucrative position.

Identifying the Ongoing Shortages in Primary Resources

So, what are these ongoing shortages? The energy sector is the most affected, but it’s not alone. We see shortages in various primary resources, including oil and natural gas. The U.S. Strategic Petroleum Reserve has dropped significantly, leaving us more vulnerable to supply disruptions.

As the demand for energy continues to rise, especially from countries like India and those in Southeast Asia, the pressure on our resources will only increase. The Permian Basin, once a beacon of hope for U.S. oil production, is showing signs of slowing growth. This raises questions: How will we balance the global oil market? What happens when OPEC regains market power?

To visualize these trends, let’s look at the investment return projections over the last decade compared to current trends:

In summary, the landscape is shifting. Investment strategies should focus on recapitalization of industries, particularly oil and gas. The need for action is urgent. Investors who can adapt to these changes stand to benefit immensely from the upcoming opportunities.

CapEx as a Key Indicator of Market Stability

When we talk about the oil market, one term that keeps popping up is capital expenditure, or CapEx. Understanding how undercapitalization affects production rates is crucial. It’s not just a financial term; it’s a lifeline for the industry. Over the past decade, the energy sector has seen drastic cuts in CapEx. This undercapitalization is influencing production rates significantly. But how?

How Undercapitalization is Influencing Production Rates

Imagine a tree that hasn’t been watered. Over time, it wilts and produces less fruit. The same principle applies to oil production. With less investment in exploration and development, we see declining production levels. The data is startling. In the past ten years, we’ve witnessed a significant drop in the percentage of S&P stocks comprised of oil. From 20% to just 1.9%! That’s a dramatic shift, signaling a market in distress.

As Adam pointed out, “The oil business is very cyclical, and that’s where the capital cycle plays the biggest role.” When companies cut back on spending, they can’t discover or develop new oil fields. This leads to supply constraints. The result? Higher prices and potential shortages. It’s a cycle that feeds on itself. Less investment leads to lower production, which leads to higher prices, which leads to more reluctance to invest. It’s a vicious cycle.

The Capital Cycle and Oil Supply Movements

The capital cycle is intricately tied to oil supply movements. When companies invest heavily, they can increase production. Conversely, when they pull back, supply stagnates. The industry is currently facing critical depletion issues due to a consistent lack of reinvestment. As Adam notes, “Finding new, profitable oil reservoirs has become increasingly difficult.”

This situation is compounded by geopolitical tensions. While CapEx issues are the primary driving force behind the current tightness in the oil market, geopolitical factors cannot be ignored. They create uncertainties that can deter investments. For instance, the dwindling U.S. Strategic Petroleum Reserve (SPR) has fallen from about 750 million barrels to 350 million. This reduction has left the country more vulnerable to supply disruptions than it has been in the last two decades. Are we prepared for that risk?

Geopolitical Tensions and Their Effects on CapEx

Geopolitical tensions can have a profound effect on CapEx. When countries face instability or conflict, companies become hesitant to invest. This hesitation can lead to a significant slowdown in oil supply. The relationship between geopolitics and CapEx is complex. It’s not just about oil prices; it’s about national security, economic stability, and energy independence.

As we analyze the cyclical nature of oil investments, we notice that CapEx serves as a key indicator of market direction. Investors need to be aware of these dynamics. Understanding how undercapitalization, the capital cycle, and geopolitical tensions interact can provide valuable insights. Are we ready to tackle the challenges ahead?

In summary, the oil market is in a precarious position. The undercapitalization of the industry, combined with geopolitical tensions, poses significant challenges. As we look to the future, it’s clear that understanding these factors will be crucial for forecasting trends and making informed investment decisions.

The Future of Oil: Geopolitics Meets Resource Management

The oil market is a complex web of interrelated factors. One of the most significant is the role of geopolitical tensions. These tensions can cause oil prices to fluctuate unpredictably. For instance, ongoing conflicts in the Middle East impact nearly 48% of the world's oil supply. When tensions rise, so do prices. It's a cycle that we must understand to navigate future challenges.

Geopolitical Tensions and Oil Prices

Geopolitical events can have immediate effects on oil prices. When conflicts arise, the supply chain becomes strained. Countries that rely heavily on oil imports may find themselves in precarious positions. The unpredictability of these tensions raises an important question: how can we prepare for potential price spikes?

Invest in strategic reserves: Countries need to maintain a buffer against supply disruptions.

Diversify energy sources: Reducing reliance on oil can help mitigate risks associated with geopolitical tensions.

Stay informed: Understanding global events can help businesses and consumers make informed decisions about oil consumption.

As Adam noted, "We are more vulnerable today to disruptions than we have been at any time in the past twenty years." This vulnerability is partly due to the recent reduction of the U.S. strategic petroleum reserve by 50%. Drawing down reserves has left countries exposed, raising questions about future stability.

Strategies for Coping with Oil Price Spikes

To cope with potential oil price spikes, we must adopt proactive strategies. Here are a few approaches to consider:

Monitor global events: Keeping an eye on geopolitical developments can help us anticipate price changes.

Develop alternative energy sources: Investing in renewables can reduce dependence on oil.

Encourage energy efficiency: Promoting energy-saving practices can lessen the impact of price spikes.

By implementing these strategies, we can better navigate the uncertain waters of the oil market. It's essential to understand that while geopolitical tensions play a significant role, they are not the only factor influencing prices.

The Importance of Strategic Petroleum Reserves

Strategic petroleum reserves are vital for national security and economic stability. They serve as a safety net during times of crisis. As we've seen, the reduction of reserves can lead to increased vulnerability. Countries must prioritize maintaining and replenishing these reserves to ensure stability in the face of geopolitical uncertainties.

Moreover, the energy industry has faced undercapitalization over the past decade. This underinvestment poses risks to supply and can lead to shortages. Rosenzweig suggests that recapitalizing the industry is crucial. By elevating share prices, we can attract investment back into the market. This revitalization is essential for addressing the looming shortages projected in the coming years.

Conclusion

In summary, understanding the interplay between geopolitical tensions and oil prices is crucial for navigating the future of the oil market. As we face increasing vulnerabilities, we must adopt strategies to cope with potential price spikes. Maintaining strategic petroleum reserves is essential for national security. By being proactive and informed, we can better prepare for the challenges ahead. The landscape of oil is changing, and so must our approach to managing this vital resource.

Investment in energy markets is volatile and influenced dramatically by capital expenditures. A lack of investment could lead to significant shortages and potential spikes in oil prices, making this a critical time for investors to reconsider their positions in the energy market.