The current state of the markets remains fragile. Hence having an adapted and flexible strategy to survive and strive is crucial. A recent interview on Natural Resource Market Insights with Goehring & Rozencwajg exposes that having an eye on tangible hard assets may offer an edge during cycle shifts (and it seems we are in one currently). Let's have a look at the principles and commonalities at play

Gold and the Anatomy of a Monetary ‘Plot Twist’

When Commodities Signal More Than Just Price

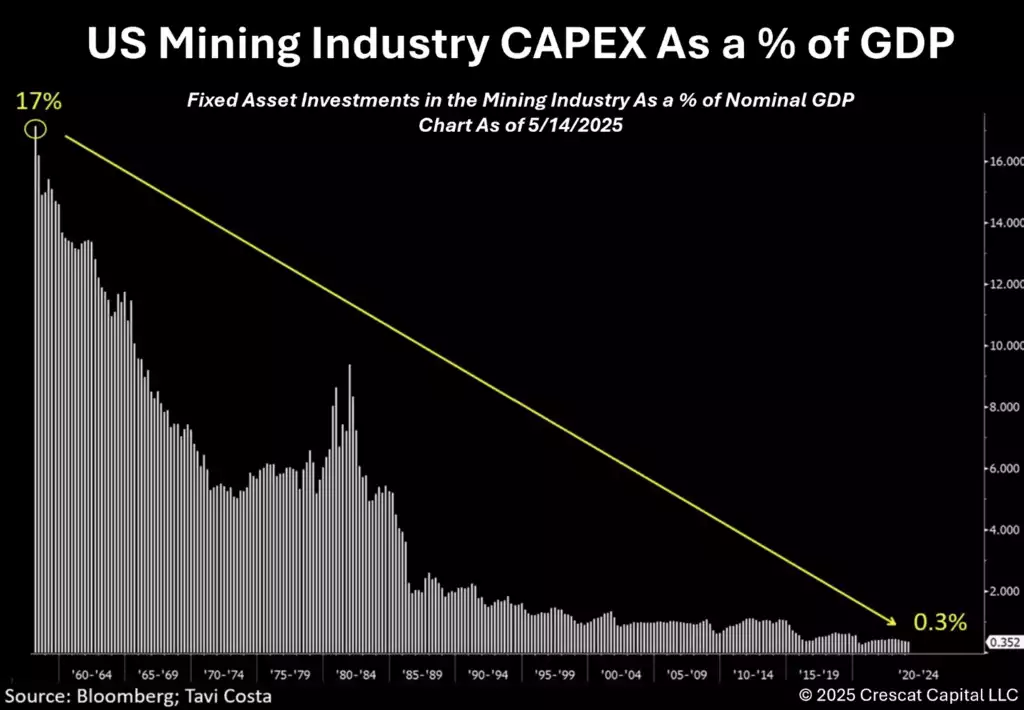

Commodities bull runs rarely happen in a vacuum. They tend to show up alongside big, sometimes messy, shifts in monetary policy. It’s almost like the market is dropping hints, but most people don’t catch on until the twist is already in motion. Investigating in the starved industry of the mining industry one can't ignore that the CAPEX is still not improving during recent years.

Source: https://www.crescat.net/mining-the-bedrock-of-innovation-and-industrial-revival/

Gold, in particular, has a knack for playing the part of the plot twist everyone should’ve seen coming.

Gold: The Canary in the Coal Mine

Over the last 12 to 18 months, gold has made strong, steady gains. Not just in fits and starts, but with a kind of regularity that feels deliberate.

Gold has been the canary in the coal mine, so to speak... The strong outperformance of gold over the last 12 to 18 months, I think has preaged this monetary regime change. (Adam Rozencwaijg)

That’s not just a clever metaphor. Gold’s role as a leading indicator during global uncertainty is well documented. When gold outperforms, it’s often a sign that something deeper is shifting beneath the surface—something systemic.

Shifting the Spotlight: From BRICS to the US

For a while, all eyes were on the BRICS nations—Brazil, Russia, India, China. There was plenty of talk about de-dollarization, about new currencies and alternative systems. But lately, the winds have shifted.

Instead of waiting for external actors to force a change, recent events suggest the next big monetary regime shift might actually start in the US. Not from the outside in, but from the inside out.

I think the change in the monetary regime is going to actually come from the US itself. It’s going to be a redollarization, not a dedollarization. (Adam Rozencwaijg)

Source: Tradingview, USD/EUR as per 18.05.25

Considering the recent decline and ongoing weakness of the US-Dollar against all other currencies - That’s a twist few saw coming. The term “redollarization” is starting to pop up, flipping the usual narrative on its head.

Monetary and Trade: Two Sides of the Same Coin

It’s easy to separate monetary policy from trade policy. But, as any first-year accounting student might point out, there are always two sides to every ledger. Money doesn’t just move around for no reason. It’s exchanged for goods, services, sometimes even just for a sense of stability.

So, when monetary regimes shift, trade regimes tend to follow. Or maybe it’s the other way around. Hard to say, really. What’s clear is that both are shifting at the same time.

April: Major US tariff announcements made headlines, signaling a possible inflection point.

Gold prices: Hitting new highs in nominal terms, again and again.

Historic echoes: Looking back 150 years, commodity cycles often start with these kinds of systemic changes.

Gold’s Outperformance: More Than Just Numbers

Some might chalk up gold’s recent run to simple economics—fear, inflation, maybe just speculation. But that misses the bigger picture. Gold’s outperformance isn’t just an economic signal. It’s a symptom of deeper stress in the system.

Commodities bull runs often coincide with big shifts in monetary policy.

Gold’s performance sometimes feels like the plot twist everyone should’ve seen coming.

Recent trends suggest the US (not just BRICS) might spark the next monetary shift.

Gold’s outperformance: not just an economic signal but a symptom of deeper system stress.

It’s easy to miss the obvious when everyone’s focused on the usual suspects. But sometimes, the real action is happening right under their noses. Consider reading recent posts as https://redmarlin.substack.com/p/navigating-the-gold-market-insights?r=ca453 or https://redmarlin.substack.com/p/gold-mining-stocks-set-for-a-run?r=ca453 on Gold and gold mining as gold, quietly making new highs, is telling a story that’s still unfolding.

Silver: The Perennial Laggard That Loves a Late Entrance

Why Silver Always Seems to Be Running Late

Silver’s reputation as the “other” precious metal isn’t just about price. It’s about timing. While gold grabs headlines, silver is usually left behind—at least at first. Some investors get frustrated, wondering what’s wrong with silver. But, as history shows, this lagging behavior is not a flaw. It’s the pattern.

"Silver's underperformance that we're seeing today is a necessary ingredient of letting us know that the gold bull market is alive and well."(Lee Goehring)

Since gold became freely traded in 1971, every major gold bull run has featured silver dragging its feet. It’s almost like silver is waiting for a cue. Then, just when everyone’s given up, it sprints ahead—sometimes overshooting, sometimes causing chaos.

Not a Bug, But a Feature

Silver’s underperformance during gold rallies is a recurring theme. It’s not a market malfunction. It’s a signal that things are proceeding as usual.

Gold rallies. Silver lags. Then, suddenly, silver erupts in a furious catch-up rally. It’s happened in the 1970s, in 1980, in 2010–11, and again in 2020.

When silver finally takes off, it’s often a warning sign for gold investors. The party might be ending soon.

There’s a common misconception that silver must lead for a gold bull market to be real. That’s just not true. The data says otherwise.

"Every bull market that gold has had since [1971], it’s been a very obvious characteristic that has reappeared... And that is silver has lagged the gold bull market."(Lee Goehring)

Numbers Don’t Lie: The Gold/Silver Ratio

Let’s look at the actual numbers. The gold/silver ratio—how many ounces of silver it takes to buy one ounce of gold—currently sits above 100. That’s high. Historically, during silver’s catch-up phases, the ratio has collapsed to around 14:1. For context, Alexander Hamilton set the U.S. Mint standard at 14:1 back in 1792. Wild, right?

Silver price: Dropped from $35 to under $30 after current “Liberation Day,” now rebounding to around $33.

Key years for silver’s wild rallies: 1971, 1977-80, 2002-2011, and summer 2020.

History Doesn’t Repeat, But It Rhymes

Why does silver always seem to lag, then explode? Maybe it’s just in the metal’s DNA. Or maybe it’s the market’s way of keeping everyone on their toes. Think about the Hunt Brothers in 1980—trying to corner the silver market. Or the Reddit crowd in 2021, attempting a “silver squeeze” like they did with GameStop. These attempts pop up almost like clockwork, especially when gold is running hot.

1979-80: The Hunt Brothers nearly pushed the gold/silver ratio back to 14:1.

2021: Reddit’s silver squeeze fizzled, but the urge to try again never really goes away.

It’s almost predictable. Silver lags, investors get impatient, then someone tries to force a squeeze. Sometimes it works, sometimes it doesn’t. But the pattern keeps repeating.

When Silver Runs, Gold’s Time Is Up?

Here’s the twist: When silver finally stages its dramatic rally, it’s often a signal that gold’s bull run is peaking. It happened in 1973, in 1980, in 2011, and again in 2020. Silver’s furious catch-up isn’t just exciting—it’s a warning. Savvy investors know to watch for it.

Silver’s lag is normal. Its rally is the real event.

When silver outperforms, gold might be ready for a pause—or even a correction.

So, is silver broken? Not at all. It’s just following its own script, as it always has. For further investigation on that topic please visit https://redmarlin.substack.com/p/insights-into-gold-silver-and-the?r=ca453.

Uranium: Where Opaqueness and Opportunity Collide

Uranium pricing is a strange mix of theater and mystery novel. Anyone who’s tried to follow it knows the feeling: spot prices jump and dip, headlines blare, and yet the real action happens out of sight.

Most investors fixate on those spot prices, watching them like hawks. But here’s the kicker—spot trades make up just 10–20% of the annual uranium volume. The rest? Locked away in long-term contracts, buried under non-disclosure agreements, and rarely discussed in public.

The Surface Is Noisy, the Depths Are Quiet

It’s easy to see why uranium feels so opaque. The futures market, which in theory should offer clues, is basically non-functional. There’s no reliable way to hedge or speculate. So, what really drives uranium’s value? Is it just a guessing game, or is there a method beneath the madness?

Despite all the secrecy, there’s a strange consistency to the market. Even though spot and term prices are set in very different ways, they tend to move together. When the spot price rises, term prices usually follow—not instantly, but eventually. It’s almost like watching two dancers, one leading and the other following a beat or two behind.

"People have always lamented the uranium industry and sector because it's more opaque than other commodity sectors. And there’s a lot of truth to that. But just because something's more opaque doesn't mean that it lacks its own fundamentals and that it has its own trends and things like that."

Why Do Investors Obsess Over Spot Prices?

It’s a fair question. If spot prices are just a sliver of the market, why do they get all the attention? The answer is part psychology, part practicality. Spot prices are public. They’re easy to track, update daily, and make for dramatic charts. Term contracts, on the other hand, are private. Details are hidden, sometimes for years. It’s like trying to judge a play by peeking through the curtain.

But here’s the catch: even with all the noise, spot prices do offer clues. They’re not perfect, but they’re often the first sign that something’s changing. When the spot price comes off a historic low—as it has recently—it’s a signal. Not a guarantee, but a hint that the tide might be turning.

Looking Beneath the Surface

For those willing to dig deeper, the uranium market rewards patience and curiosity. The real trends aren’t found in daily price swings or sensational headlines. They’re hidden in the slow, steady movement of term prices, in the contracts signed behind closed doors, and in the supply-demand fundamentals that don’t make the news.

Opacity doesn’t mean chaos. It just means that finding the truth takes more work. Fundamentals still matter—production costs, utility demand, geopolitical shifts. The market may be shadowy, but it’s not random.

Conclusion: Embracing the Unknown

In the end, uranium stands as a reminder that not all markets are created equal. Some, like gold or oil, are open books. Others, like uranium, are more like puzzles with missing pieces. But that’s where opportunity lives—at the intersection of what’s seen and what’s hidden. For those who look beyond the obvious, who aren’t afraid of a little mystery, uranium’s opaqueness isn’t a barrier. It’s an invitation.